Money Management 101 – How to Create a Spending Plan

“A budget is telling your money where to go instead of trying to figure out where it went.” –Dave Ramsey

Many people hear the word “budget” and they cringe. They hear that word and they get this mental image of their money being put in jail so they can’t spend it on what they want. Can you relate to that? I know I used to feel that way and then I learned what a budget REALLY was…

A budget is a plan to spend your money (spending plan) on what YOU WANT to spend it on before you spend it. This keeps you from accidentally spending it on something you don’t really want as much. For example, if one month after spending $200 on eating out at restaurants you didn’t have enough money to pay your car payment, you might find yourself saying at the end of the month that you wish you hadn’t eaten out as much. The scary thing is, without a spending plan, you don’t have a clue what you CAN spend on eating out and still make all of your other payments! So what a spending plan does is it gives you specific permission to spend money and the peace of mind of knowing that you’ll be able to pay your bills and meet your financial goals. Even if you do have a surplus at the end of the month without a spending plan in place, a good spending plan can give you greater control over your finances and help you reach your goals more rapidly.

So, how do you start? The very first thing I recommend is if your finances are yoked with another person (a spouse or other family member) sit down with that person and get on the same page financially. Make your spending plan a team effort!

- Come up with a list of priorities/goals

“The best way to simplify life is to set your priorities straight.” – Nishan Panwar

Get excited! This is where you get to start deciding how you’re going to spend your money. For the first time you will be in control of your finances! I recommend starting with the things you know you must spend some of your money on such as food, shelter, and transportation. Then work your way down to things that serve to improve your quality of life (cable TV, cell phone, vacations, and internet etc.). Be as specific as you can here because it will make it easier when you work on steps 3 and 5. See the sample list below:

- Giving

- Rent/Mortgage

- Groceries

- Natural Gas/Water/Electricity

- Car Payment

- Gasoline

- Home/Car Insurance

- Other Debt payments

- Medical

- Cable/Cell Phone/Internet/Online Video Service

- Pets

- Clothing/Personal Care

- Other

- Fun (Movies, Vacations, etc)

- Restaurants

- Saving

- Retirement

- Total your monthly take-home income

“A wise man will live as much within his wit as within his income.” – Philip Stanhope

Include all sources of income. Review at least 1 month but preferably 3 months to get a good average. If you’re salaried you can convert your income to monthly income using the math below If you are paid

Weekly (Take Home Pay x 52 / 12)

Bi-Weekly (Take Home Pay x 26 /12)

Bi-Monthly (Take Home Pay x 2)

If your income is irregular look at your previous 12 month total take-home income and divide that by 12. On months when you earn more than this you will put the difference into savings to draw from in the months that you earn less. This will help provide a more steady income.

- Look at what you’ve spent your money on

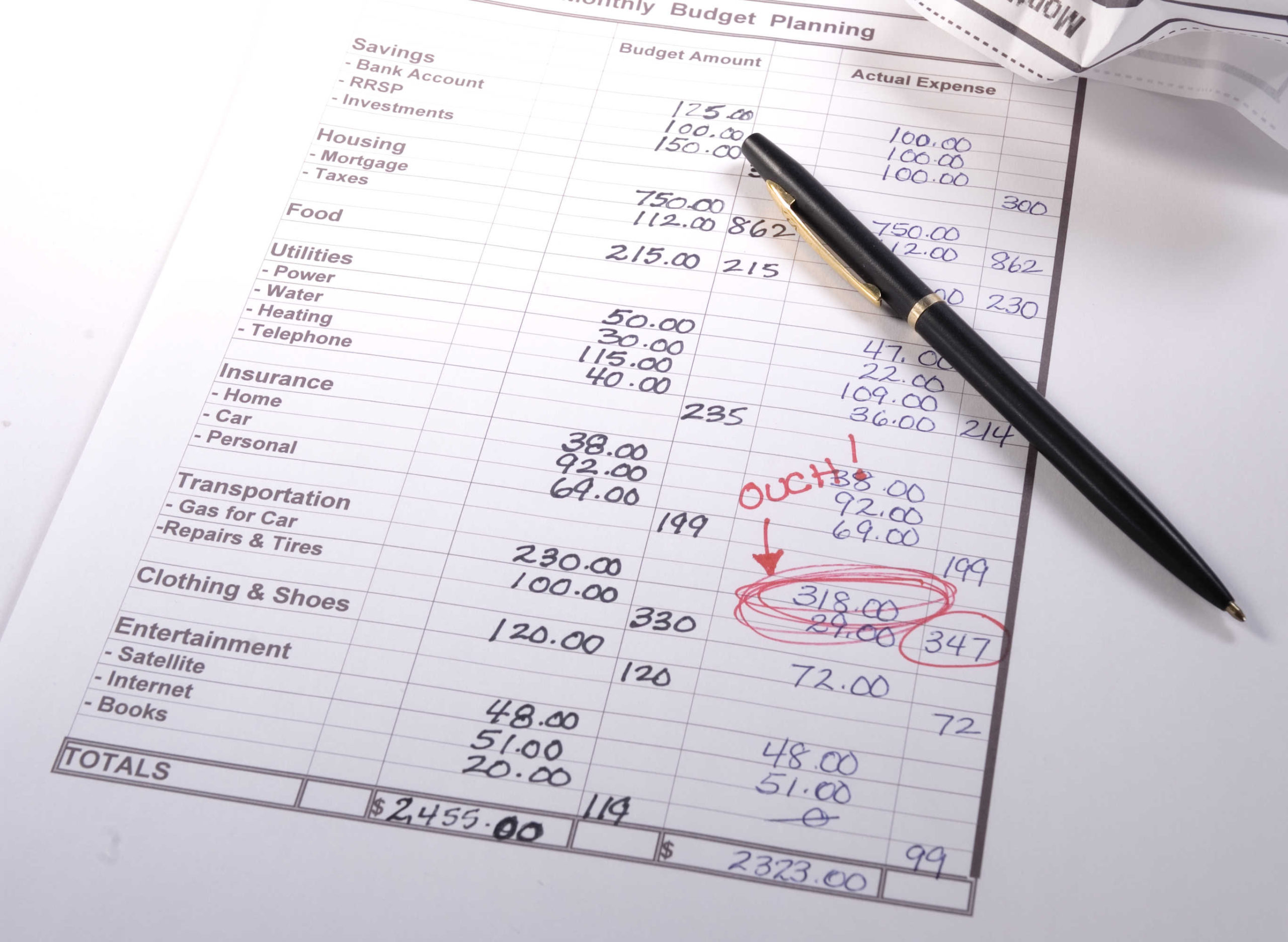

“You cannot keep out of trouble by spending more than you earn.” – William J.H. BoetckerReview your bank or credit card statements for the previous 30 days and categorize every transaction into one of your priorities that you listed in step 1. If you have an item that cannot be classified into your priorities, either add an additional priority or make a note that you’re not going to spend money on that anymore. Total each category. - Make S.M.A.R.T. Savings and Retirement Goals

“Don’t save what is left after spending, but spend what is left after saving” – Warren Buffet

S – Specific

M – Measurable

A – Attainable

R – Relevant

T – Time-Bound

“I want to save to buy a house” is an admirable goal but it can be made much better if it is made to be SMART. “I want to save $20,000 in the next 5 years to use as a down payment on a $100,000 house” is a much better goal because you assess its attainability, measure your progress, and ultimately be more successful at achieving your goal. If you know you can only save $200/month then you can measure that it will not put you on track to achieve your goal of $20,000 in 5 years. At $200/month it would take 8 years and 4 months to save the money. This gives you the immediate opportunity to adjust your goal to make it attainable ($12,000 in 5 years) or adjust your budget so you can plan on coming up with the $334/month needed to achieve your goal. Set realistic goals and reward yourself as you make progress toward completing them.

- Build Your Customized Spending Plan

“If you fail to plan, you are planning to fail.” -Benjamin Franklin

As you begin to compile your spending plan I want emphasize that it will not be perfect. There are things that will happen that you may not have planned for (car trouble). The way that you can account for the unexpected is to have at least 20% of your income that is set aside for savings/retirement. This ensures that you are spending less than you make and can begin building wealth. If there’s an expense that you’ve failed to account for then adjust your budget accordingly. As things happen and your life changes your budget will also need to change. Your budget should always equal your income. Every dollar should be given a job! The sample below is based on percentages to give you a guide but as you build your budget use the dollar figures you’ve come up with in steps 3 and 4 as a starting point and adjust from there.

INCOME: 100%

- Giving 10%

- Total Housing 45%

- Groceries 5%

- Transportation 10%

- Debts 5%

- Fun 5%

- Savings 10%

- Retirement 10%

TOTAL: 100%

Remember, this is your budget, make sure it fits your expenses and priorities. As you go through this process it is normal to re-evaluate some of your expenses. It may mean making some sacrifices to make sure that total doesn’t exceed your income. It will take up to 3 months to dial it in but once you have it honed in you will find financial peace knowing that you are in control of your money.

- Ensure you remain accountable to your spending plan

“Accountability is the glue that ties commitment to the result.” – Bob Proctor

Look at your spending habits on a weekly basis to see if you are in line with your spending plan. If you find yourself going over-budget in one area don’t worry! Evaluate your spending plan to see if you have the right amount available for that category. You’ll need to take something from another category to cover any area you overspent in.

If you find that you are having trouble overspending in a particular area that you know is appropriately budgeted, get creative. If you have $150 set aside for “fun” that month go to the bank at the beginning of the month and withdraw that $150 in cash. Put that cash in an envelope labeled “fun”. Every time that you do something fun, only spend money from that envelope. Know that once the envelope is empty you cannot spend any more on that category.

At the end of every month, compare what was spent to what was budgeted and decide whether you need to tweak your budget. If you are married do this with your spouse and identify areas of improvement. Also, make sure your budget still lines up with your priorities. Make it a date night so it is something you both can look forward to. If you are single, get one or several of your close friends to budget with you so you can celebrate your successes together and hold each other accountable.

If you follow these simple steps you will find yourself knowing what your money is being spent on and you will be able to feel good that it is being spent the way that you want to spend it.

The financial information provided in this blog is intended for general education and may not be specific to individual situations. Please consult a financial advisor prior to making any major financial decisions.

Written by: Daniel McMullen, Team Leader at Royal United Mortgage LLC

Published: 3/17/2016